SAVE TIME AND TRADE MORE

SAVE TIME AND TRADE MORE

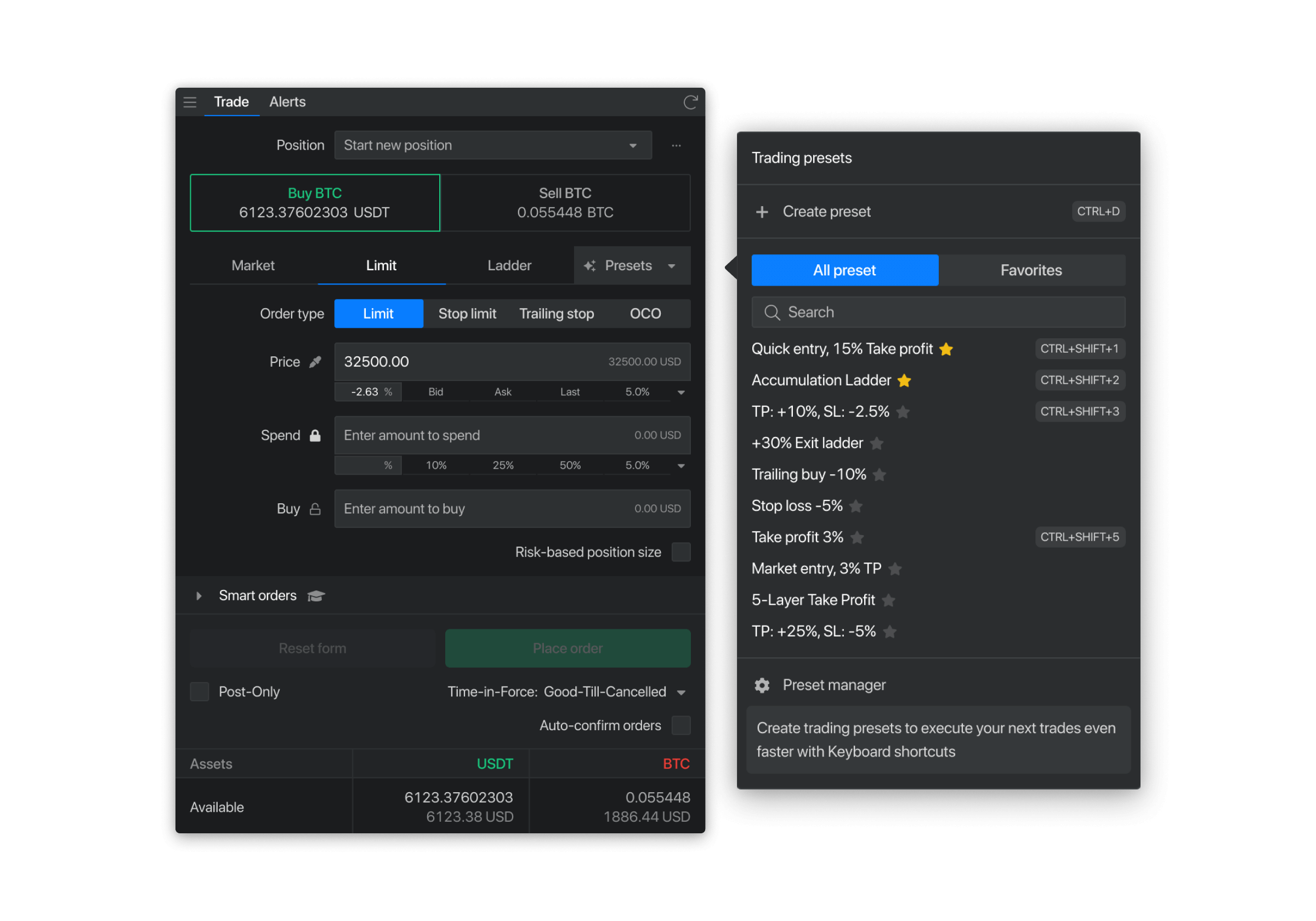

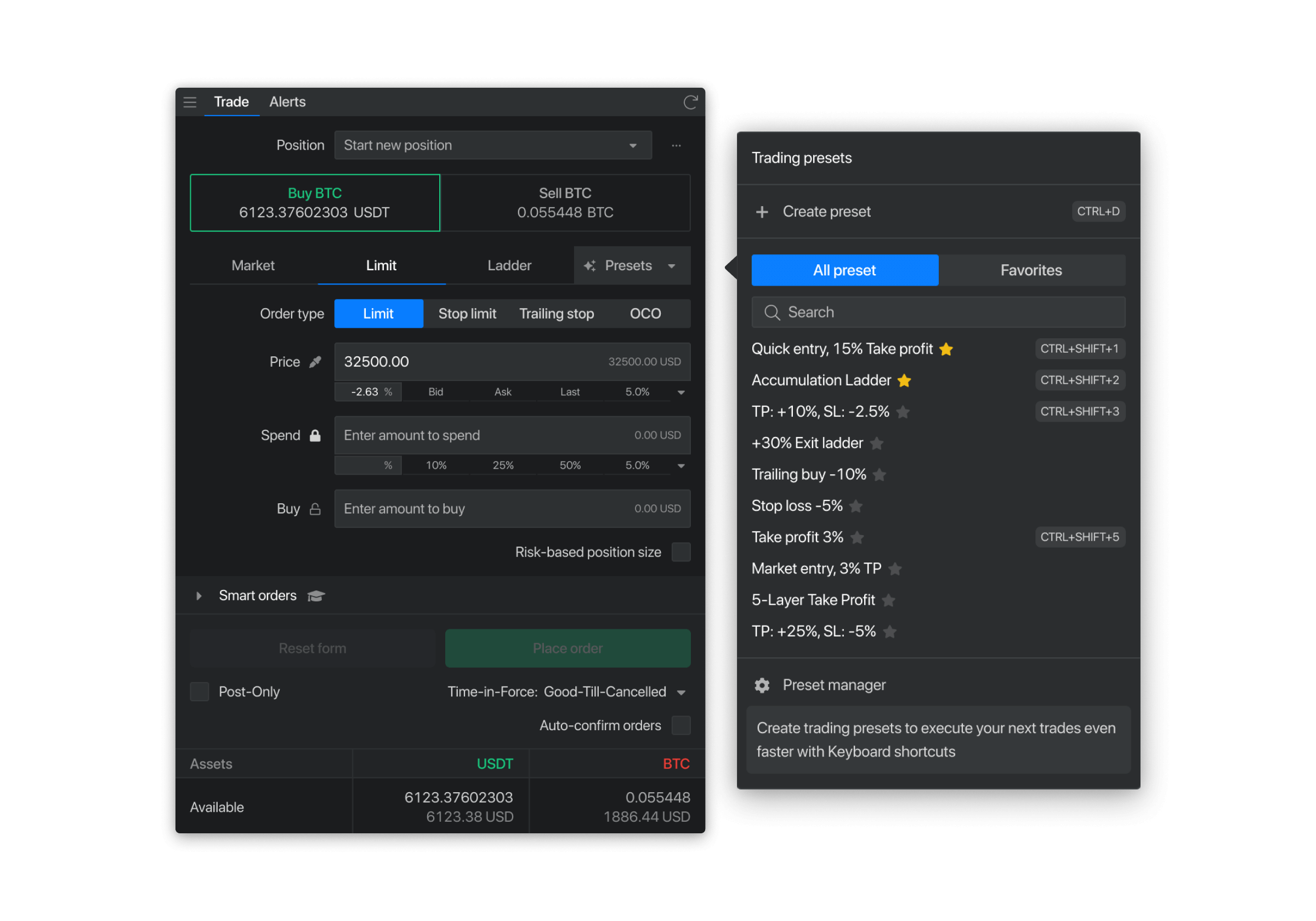

Using trade automation is key to increasing the number of trades you can do. Set up your entry and exit settings and let the system take over. Use Stop Loss, Take Profit, Trailing, Ladder & OCO orders. Also, you can use Trailing Take Profit or Trailing Stop Loss.

Get the most up-to-date market data to manage risk and enhance your trading performance.

Adjust the time frame, add indicators, and automate your trade in a few clicks.

ADVANCED AND PROFESSIONAL

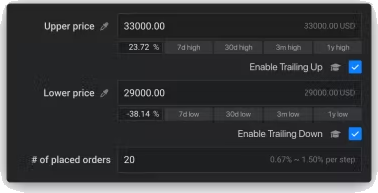

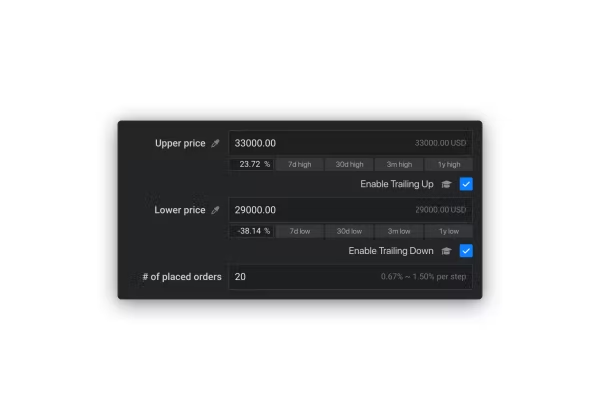

Ladder entry or dollar cost average

Setting up a position with multiple entry orders will ensure that you are able to slowly enter the market and reduce your average entry price. The system will reserve your entry orders on the exchange and adjust your exit orders as soon as a new entry order is filled.

TRY NOWADVANCED AND PROFESSIONAL

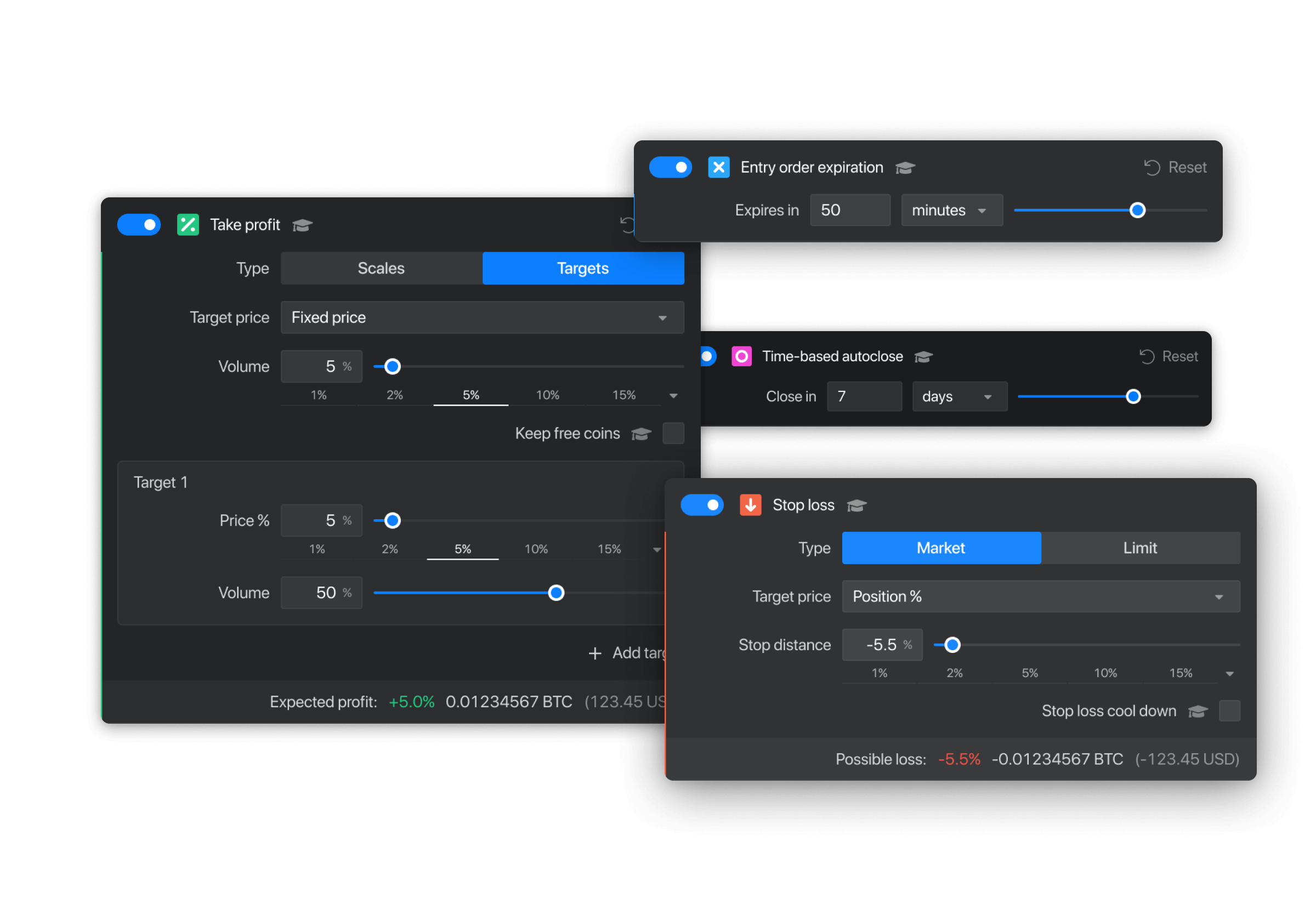

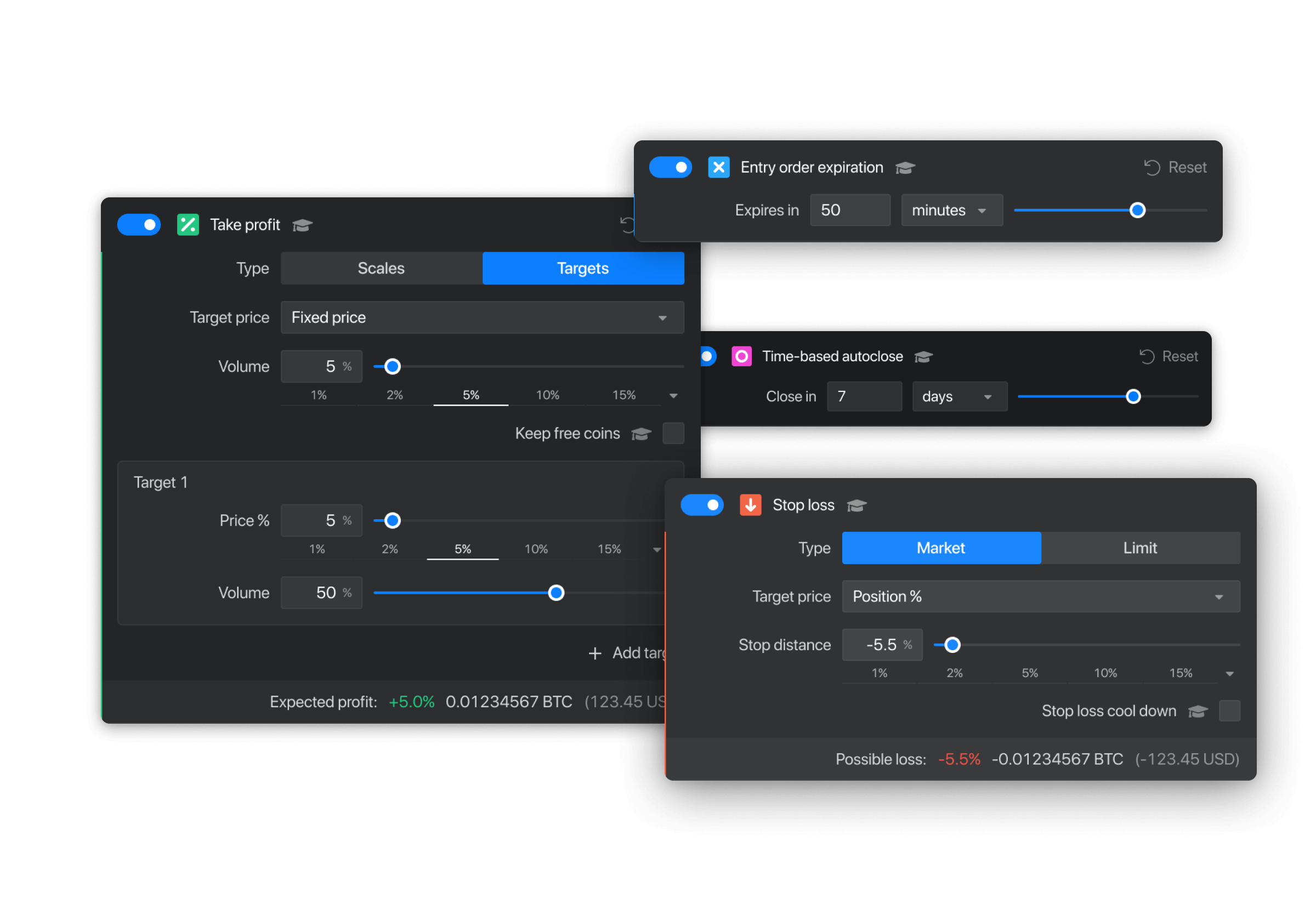

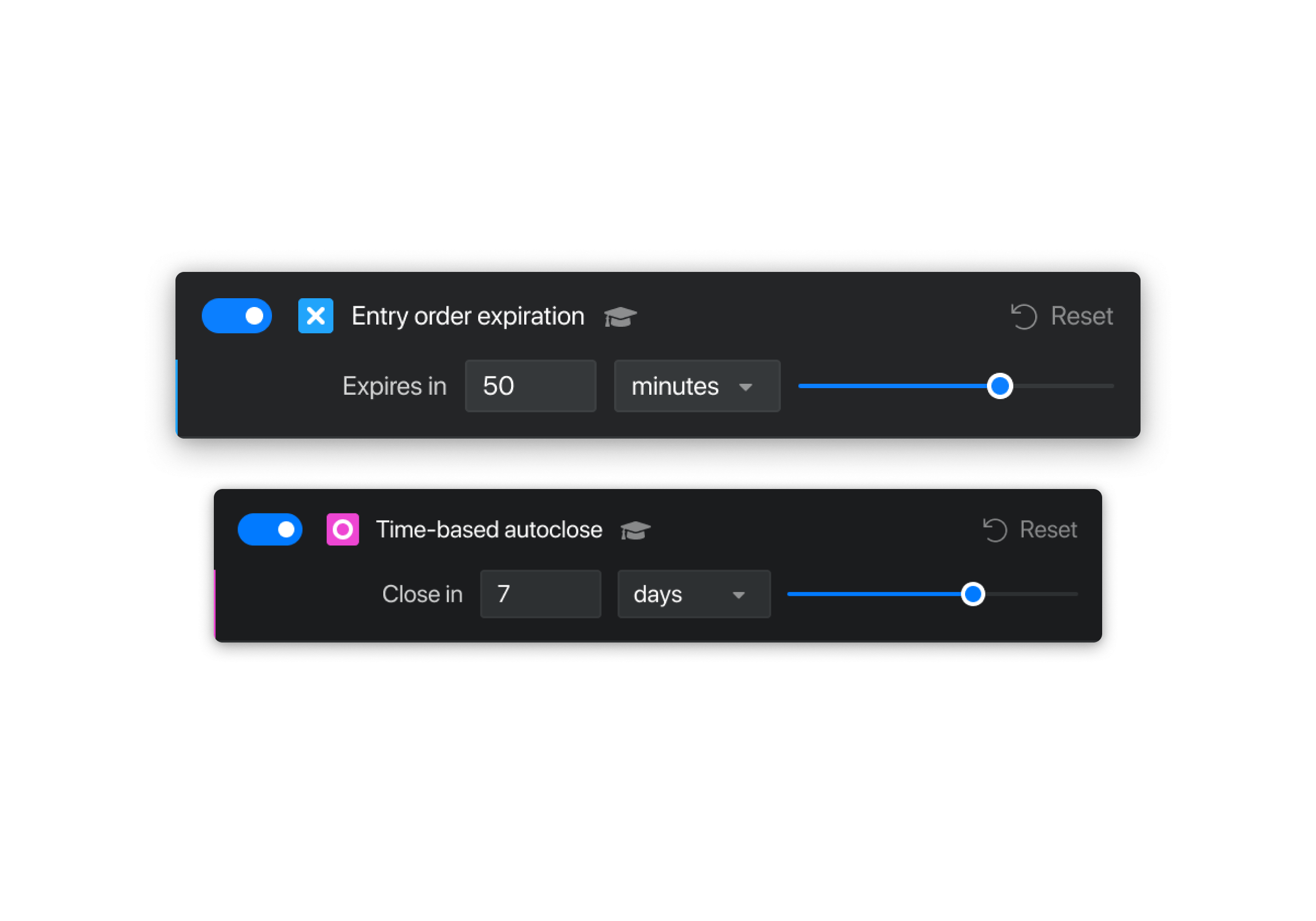

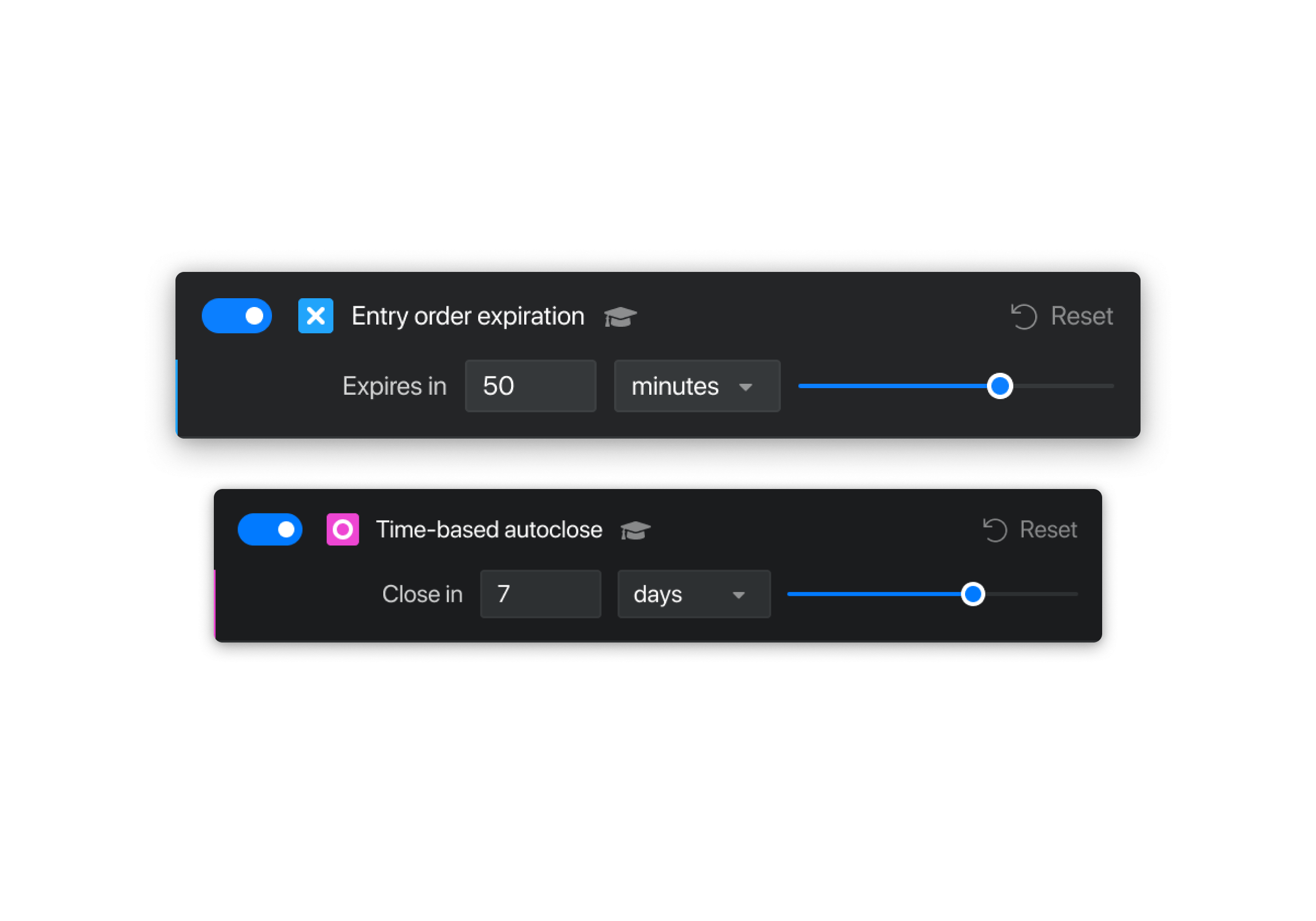

Entry time expiration

Using limit orders is a great way to only enter the market if the price reaches your desired level. It’s generally not a good idea to leave your entry orders open indefinitely, so using a timer to automatically cancel your position is a great way to eliminate the risk of getting stuck in the wrong trade.

TRY NOW

ADVANCED AND PROFESSIONAL

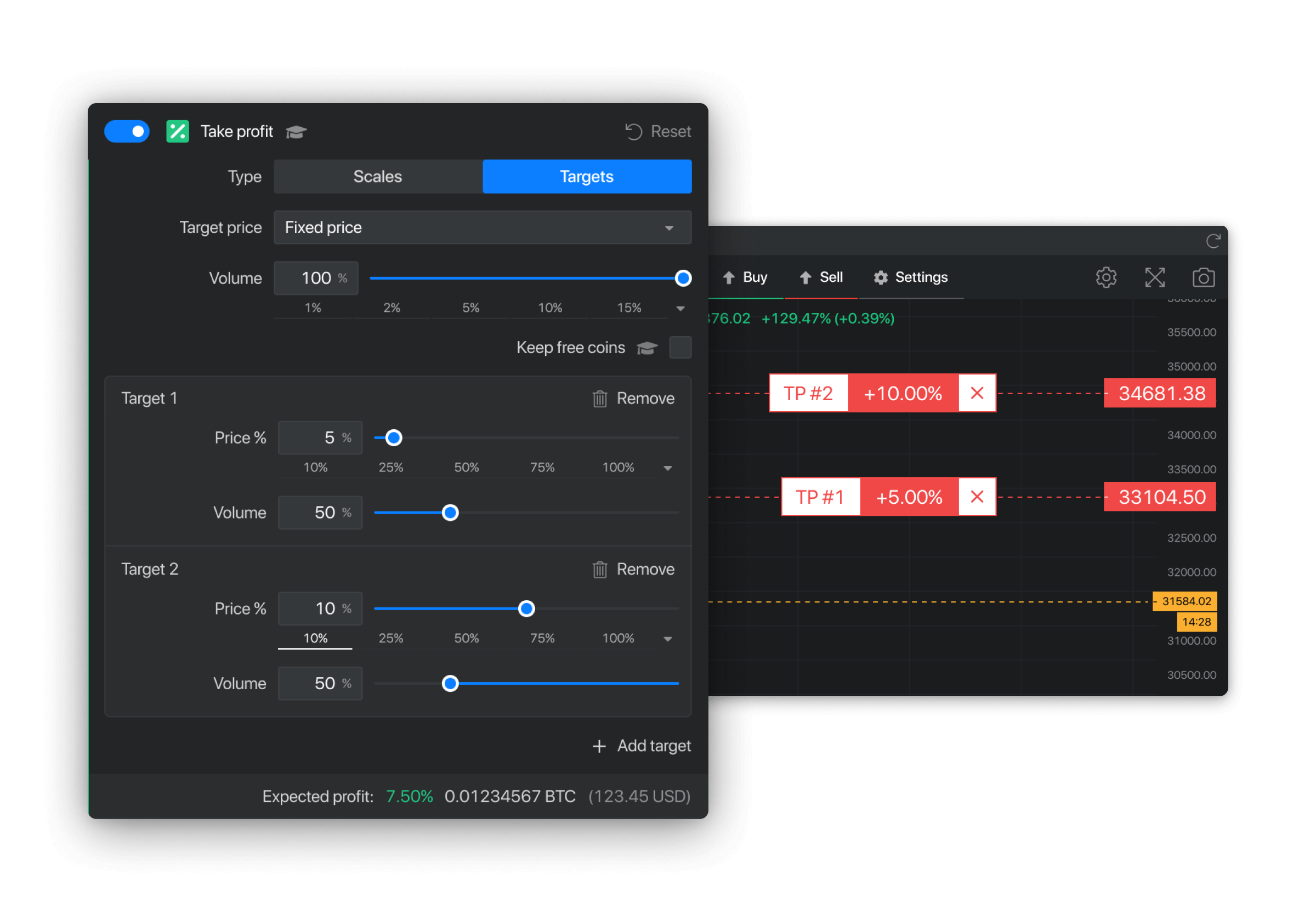

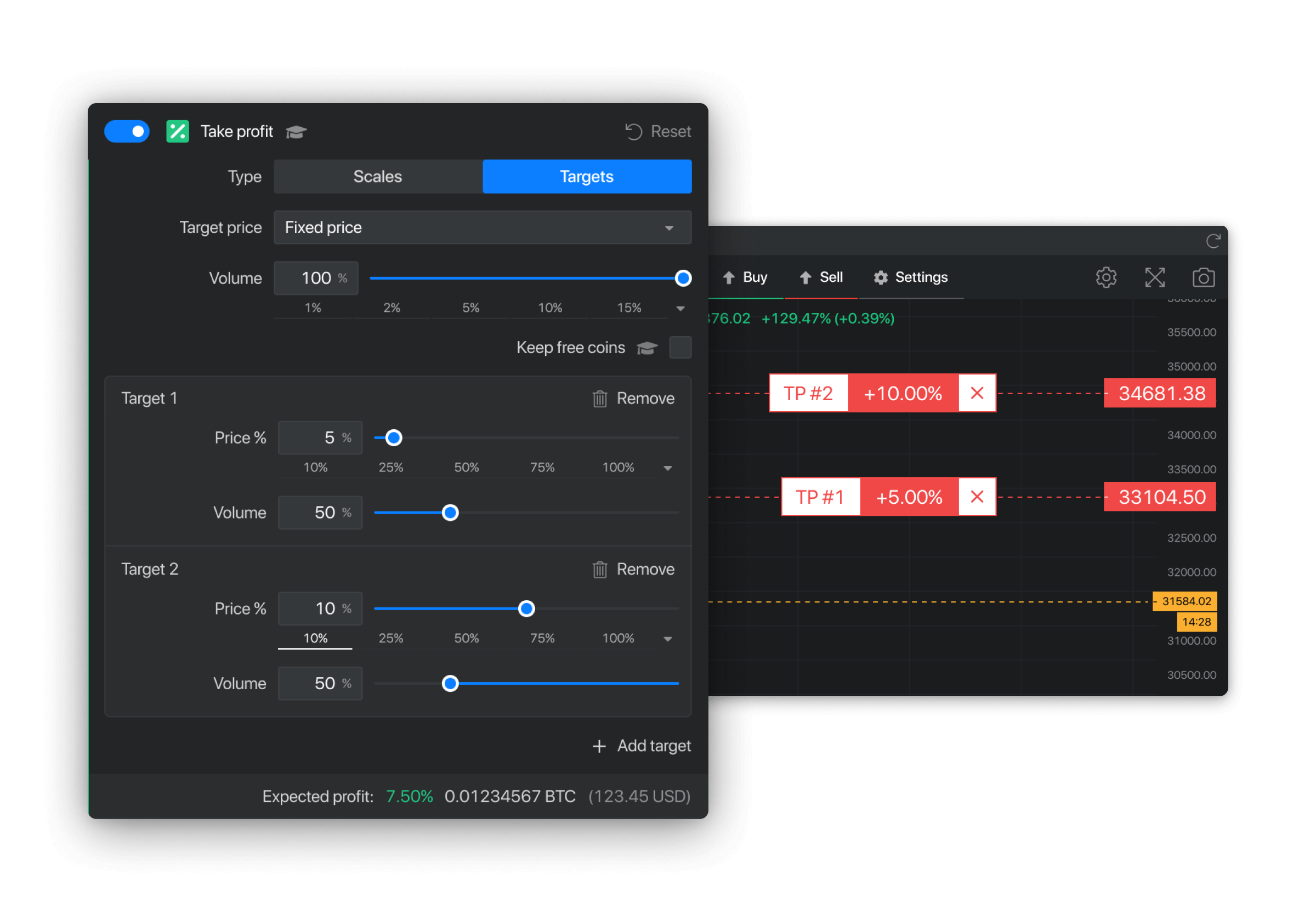

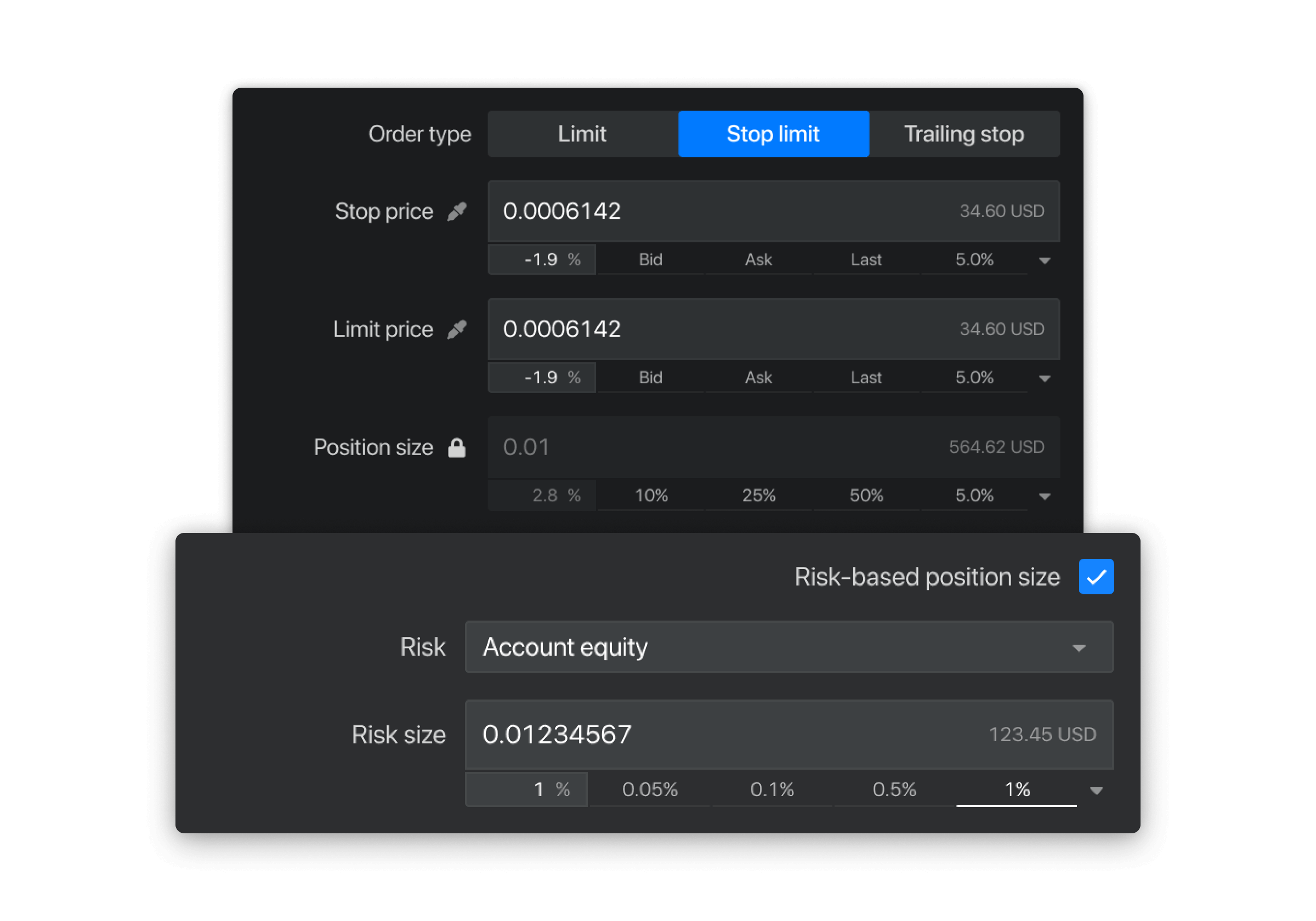

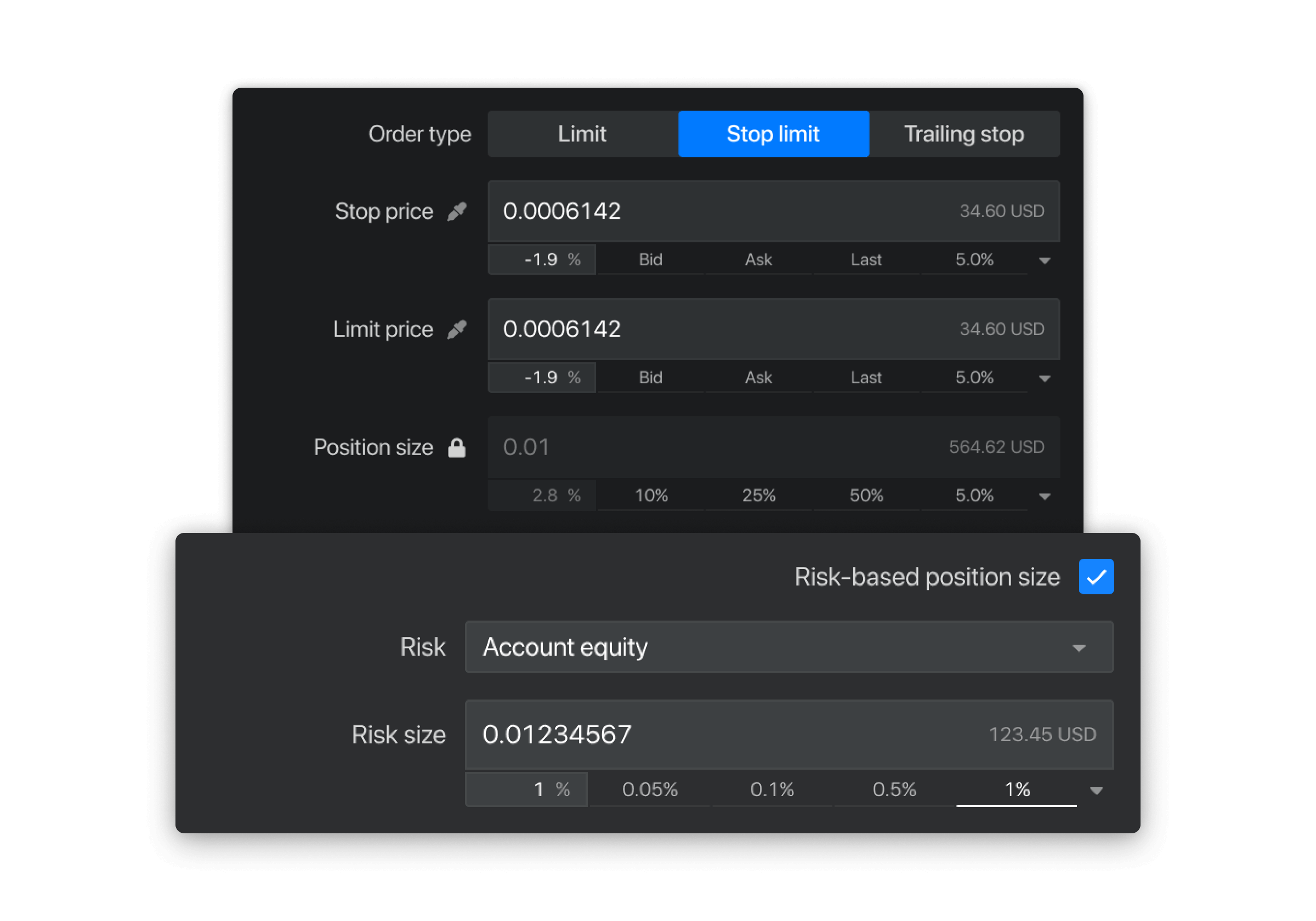

Take profit orders

After entering a position, you will need to exit the position at your desired exit percentage. Using the take-profit orders, your position will automatically place exit orders on the exchange as soon as entry orders are filled.

This allows you to even make trades while you are away from your computer, or if you’re busy looking for the next market to trade.

TRY NOWADVANCED AND PROFESSIONAL

Stop loss orders

In order to protect your position or to lock in your profits, you can setup a stop loss. As soon as you have executed entry orders, the system will monitor the price level. When the price reaches your stop price, your position will be canceled and a market or limit is used to exit the position. You can use a cooldown, to prevent stop loss execution on fast price action.

ADVANCED AND PROFESSIONAL

Time based auto close

If you don’t want a position to take too long, you can specify the time a position is allowed to stay open. When the time has reached, the position will be closed at market value.

TRY NOWHow To Use the Take Profit and Trailing Stop Limit Orders?

Start in 3 easy steps:

Start in 3 easy steps:

Request Access

Start by creating a free account with a valid email addreess, and confirm registration. Once done, choose one of the available tariff plans, subscribe and explore the marketplace for a bot.

Connect Exchanges API

You can link any account from the following exchanges: Crypto.com, Binance, Binance USA, Bybit, Bitmex, Huobi, and Bitget. Don't fret, you're almost there!

Enjoy Trading!

Everything is up and running. You can now monitor your bots and start tracking your returns, while slightly adujsting your strategy as the market evolves.

Don’t Miss our future updates. Get in touch for next...

Manage and automate your crypto

Portfolio with Botix